Copula methods

Modelling correlation between risks

Overview

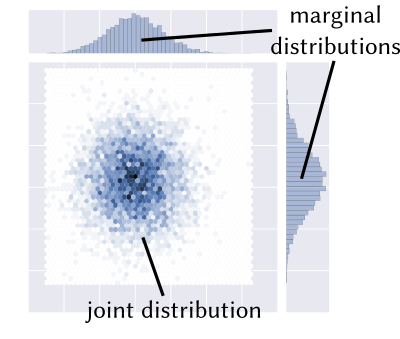

Copulæ are an interesting mathematical tool to represent correlations

between probability distributions. They can be used to represent complex

dependencies in multivariate risk models, when more basic tools such as

multivariate gaussian distributions are inappropriate. One commonly used

application is sampling from correlated random

variables.

Copulæ are an interesting mathematical tool to represent correlations

between probability distributions. They can be used to represent complex

dependencies in multivariate risk models, when more basic tools such as

multivariate gaussian distributions are inappropriate. One commonly used

application is sampling from correlated random

variables.

Appropriate modelling of dependencies between model input variables is a very significant issue in risk models in a number of application areas. For example, an inappropriate (simplifying) assumption of gaussian dependencies between the risk of various financial instruments was one of the factors that led to the global financial crisis of 2008.

Illustrations of the concept are provided in finance, where the method first reached prominence. We also show applications in other areas, including insurance, management of natural hazards, and quality management in manufacturing.

This submodule is a part of the risk analysis module.

Course material

|

Copula and multivariate dependencies |

In these course materials, applications are presented using the NumPy, SciPy and statsmodels libraries for the Python programming language. We have some material on getting started with Python that explains how to install Python on your computer or try out our computational notebooks using free online services.

Other resources

We recommend the following sources of further information on this topic:

The Coursera course Financial Engineering and Risk Management (Columbia University)

Material by Prof. Arthur Charpentier (Université de Montreal), including his great blog, Freakonometrics

Teaching material by Prof. Paul Embrecht from ETH Zurich, an important researcher in the use of copula techniques in finance

Article ‘The Formula That Killed Wall Street’? The Gaussian Copula and the Material Cultures of Modelling by Donald MacKenzie and Taylor Spears

Published:

Last updated: